Contents

Index Funds that replicate specific indices like the NIFTY 50, NIFTY Midcap 150, etc. follow this strategy and are examples of passively managed Mutual Funds. These costs do matter as over a longer term, they can make a substantial difference to your returns. The investment objective is to generate long term capital appreciation by investing in securities of MSCI EAFE Top 100 Select Index subject to tracking error.

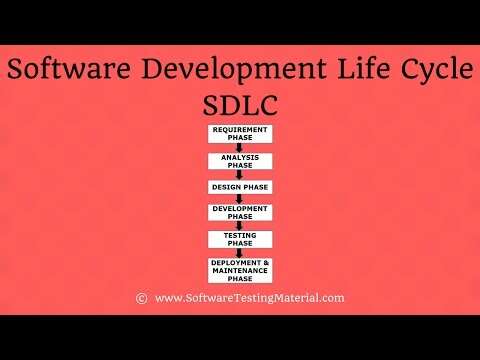

The fund manager and his/her team take tactical calls including which stocks to buy or sell and at what price. This style of investing often involves multiple buy and sell transactions, so, is called active investing, and schemes implementing this strategy are called actively managed mutual funds. In passive funds, there is no need for the fund manager to actively pick stocks for investment.

ICICI Prudential Bluechip Fund-Growth

Since an average Indian investor can not track the international markets on a continued basis. Low-cost passive funds such as Nasdaq FoF and S&P 500 Index Fund have always delivered double-digit returns in the past and provided diversification benefits along with Rupee-cost benefits. An index fund tracks a market index and replicates the performance of the underlying index. Unlike actively managed funds, for index mutual funds, fund managers have little or no role to play in buying and selling of stocks. Thus, the cost of managing an Index Fund is significantly lower than that of an actively managed Equity Mutual Fund. In an actively managed Mutual Fund, you invest your money in a scheme and then an expert called the Fund Manager uses his or her expertise to build a portfolio of securities.

- This investment option is very effective for an average investor.

- You can see this – the RER of all funds went to a much higher level – as much as 0.5% to even 1.5% during this time.

- They exchange a basket of stocks for units from a market maker or vice versa.

- Franklin India Feeder Fund is weighted 40% towards the IT sector and 18% of the healthcare sector, which are dominant themes right now.

- Before investing, please consider your risk tolerance and investment objectives.

But historic data shows that if you stay invested for the long term, the risk of losing money in index funds is almost negligible. Securities transaction tax is levied on equity funds but not on debt funds! When equity funds are redeemed, securities transaction tax has to be paid on the sale amount. This amount is imposed at the same rate as on equity sales. One thing that is clear from the above illustration is that lower expense ratio means lower costs and higher returns. Even a 1% difference in costs can make a big difference to the eventual corpus.

FAQs on Best Index Funds in India

And because of a higher active management fee, performance lags, which has happened in India in the large caps at least. Hence, the returns are approximately similar to the ones offered by the index. Consequently, investors preferring predictable returns and interested in the equity market usually invest in this fund. To filter index funds based on different parameters, use Tickertape’s Mutual Fund Screener, loaded with over 50 filters.

With the current situation across the globe, the financial markets are facing issues of deep concern. While investors were willing to take a risk in the past, today’s conditions have pushed the majority of the investors to look for a Safe Haven. This means they are looking for an investment that will yield higher returns or at least stable returns. The Association of Mutual Funds in India stated that index funds had gathered an AUM of Rs. 7717 crore on November 2019.

Investment Horizon

It is always worthwhile to seek the advice of a financial advisor. Index funds are available at a lower expense ratio as compared to actively managed funds. An Index fund tracks a broader market index such as Sensex or Nifty and their IC Markets Forex Broker Review portfolio will comprise the same stocks as in the Sensex or Nifty in the same proportions. Index funds are also known as passive funds since they track a particular index and do not require a high level of management of the fund.

In international markets, index funds seem to have a performance edge. Next in line is the Motilal Oswal Nifty 50 Index fund with an expense ratio of 0.10%. The fund was launched in August 2019 and is benchmarked against Nifty 50 Index TRI. The average AUM of the scheme was Rs 76.28 crore at the end of June, 2021. The scheme has generated 50.50% returns in the last one year.

How long do you need to hold index funds?

Index funds work for investors who have a long-term investment horizon. It is important to stick to the investment period as decided by the investor in order to have a better return.

For instance, if you want to invest in India’s biggest companies, the index will be SENSEX or NIFTY 50. These funds from three AMCs fall under the Large Cap and Large and Mid Cap category. For those who want to make impressive profits in the short-term or during the swings of the market, an index fund couldn’t be their ideal choice. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. The external links provided in our website to the depository participant’s website are provided solely for your convenience and may assist you in investing in ETFs. Get a plan to invest a fixed amount every month and achieve your desired savings.

Nippon India Index Fund – Sensex Plan

The tracking error measures the deviation of fund return from benchmark it is tracking. It is the difference between the index fund return and its benchmark return. The lower the tracking error, the better the fund’s performance. Indices typically comprise a basket of stocks that are diversified across multiple sectors and there are also limits to the exposure to individual stocks that an index can have.

Which index fund is best in 2022?

- IDFC Nifty 50 Index Fund.

- Tata S&P BSE Sensex Index Fund.

- ICICI Prudential Nifty Direct Plan-Growth.

- HDFC Nifty 50 Plan Direct-Growth.

- SBI Nifty Index Direct Plan-Growth.

- Aditya Birla Sun Life Nifty 50 Direct-Growth.

- Axis Nifty 100 Index Fund Direct-Growth.

- Tata Index Nifty Direct.

If you hold the fund for longer than a year, the returns you earn on it will be called Long-Term Capital Gains . Any amount above this is taxed at 10% without the benefit of indexation. A capital gain arises on the redemption of units of the index fund. The gains can either be information available for this short-term or long-term depending on the holding period of the units. Want to put your savings into action and kick-start your investment journey 💸 But don’t have time to do research? Invest now with Navi Nifty 50 Index Fund, sit back, and earn from the top 50 companies.

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

They passively track the performance of a particular index. Unlike actively-managed funds, index funds are not meant to outperform the market, but mimic the performance of the index. When an investor is planning to invest in index funds, they should pay attention to the tracking error of the fund.

We make no representation or warranty regarding the accuracy of the information contained in the linked sites. We suggest that you always verify the information obtained from linked websites before acting upon this information. Also, please be aware that the security and privacy policies on these sites may be different than SBI Mutual Fund’s policies, so please read third party privacy and security policies closely.

What is the best index fund to invest in?

There is nothing called as Best Index Fund. To pick an index fund you first need to decide where you want to invest. For instance, if you want to invest in India’s biggest companies, the index will be SENSEX or NIFTY 50. Next look for funds that track that particular index. Among the options go with the one with the lowest expense ratio.

Passive investing, on the other hand, may gain returns that are parallel to the index since these track the index selected. Index funds have been the talk of the town after they outperformed their actively-managed large cap Understanding The Difference Between Data, Information And Business Insights peers in the last couple of years. The Indian mutual fund industry is slowly gravitating towards the passive investment model. Many big fund houses have ventured into the space with some new and interesting offerings.

Neither Winvesta nor any of its affiliates are acting as an investment adviser or in any other fiduciary capacity. Accordingly, customers are expected to undertake their own due diligence in consultation with their own advisors and are advised not to solely rely on the Information. Any such reliance shall be at the customer’s own risk. Alpaca Securities LLC, a member of the Securities Investor Protection Corporation , will transmit your orders to the stock exchange and will serve as the custodian for your securities account. In the event that Alpaca Securities LLC, fails and is placed in liquidation under the Securities Investor Protection Act, securities in your brokerage account may be protected up to $500,000. The investment seeks to provide investment results that correspond to the price and yield performance, of the Indxx Global Fintech Thematic Index.