A sound capital structure enables management to increase the profits of a company in the form of higher return to the equity shareholders i.e., increase in earnings per share. This can be done by the mechanism of trading on equity i.e., it refers to increase in the proportion of debt capital in the capital structure which is the cheapest source of capital. If the rate of return on capital employed (i.e., shareholders’ fund + long- term borrowings) exceeds the fixed rate of interest paid to debt-holders, the company is said to be trading on equity. Thus trading on equity refers to an arrangement under which the company makes use of the borrowed funds or preference capital carrying a fixed rate of return in such a way as to increase the rate of return on the equity share capital. Therefore, a company, by issuing preference shares and debentures, can considerably increase the rate of dividend on the equity shares.

A hedge fund generally is not restricted from dealing with any particular counterparty or from concentrating any or all of its transactions with one counterparty. In the event of a sudden drop in the value of the hedge fund’s assets, the investment manager might not be able to liquidate assets quickly enough to pay off the margin debt. In addition, the degree of correlation between price movements of the instruments used in a hedging strategy and price movements in the portfolio position being hedged may vary. Moreover, for a variety of reasons, the investment manager may not be able to, or may not seek to, establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. An imperfect correlation may prevent a hedge fund from achieving the intended hedge or expose a hedge fund to risk of loss.

Capital structure substitution theory

The overall cost of capital begins to rise because the rise in cost of equity is more the benefits of cheaper debt. The more rapid the expansion, the greater the need to seek all possible sources of capital, ordinarily, rate of expansion of business is the greatest at the beginning of the firm’s life, gradually decreasing as the market’s saturation point is reached. The sales of the company are growing and to support this, the company wants to raise additional funds by borrowing Rs. 15 lakh from banks. Thus, a finance manager in his endeavour to maximise his owners’ welfare would, in the first instance, select the best pattern of capitalisation with greater amount of skill and prudence. Any error in this respect may jeopardize financial stability of the firm and land it in grave financial crisis.

If there is a prolonged slump or depression, the company may find it very difficult to make these fixed payments. To obtain the benefit of ‘trading on equity’ the business must have an established and non-speculative field of operations with stable earnings. The benefit of trading can be obtained better by companies which have an established business with stable earnings. In this case, out of Rs. 2, 00,000 profits earned by the company Rs. 60,000 has to be paid as interest on debentures and Rs. 40,000 has to be paid as preference dividend.

If the amount of equity capital raised is relatively less and the amount of borrowed funds and preference shares is relatively more, then it is said to be trading on thin equity. According to this approach, the cost of equity capital and cost of debt capital are assumed to be independent to the capital structure. The value of the firm rises by the use of more and more leverage and the weighted average cost of capital declines. Modest investors like debentures or preference shares while investors interested in speculation prefer equity shares. So, a firm will have to use a variety of securities in order to appeal to various types of investors. Since a considerable amount of risk is involved in starting a new business, its ideal capital structure is one in which equity share is the only type of security issued.

Capital Structure – Introduction

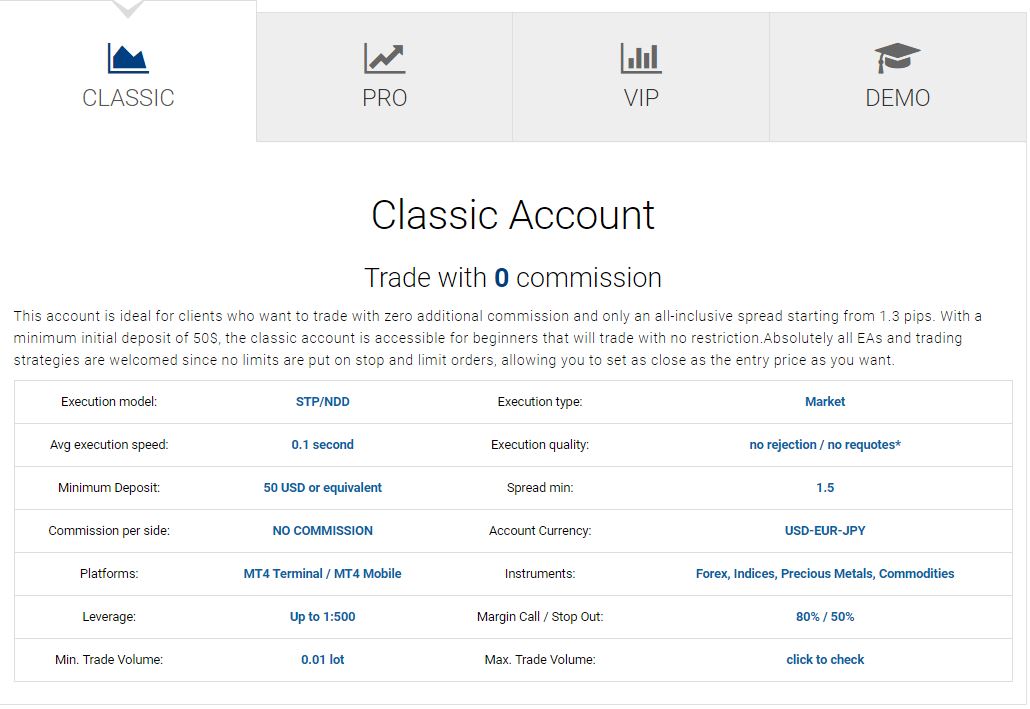

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. We want to clarify that IG International does not have an official Line account at this time. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Some have sought to protect themselves by fostering a ‘team culture’, while others, such as hedge fund Brevan Howard, have used employee non-compete clauses and turned to the courts in a bid to limit the impact of important staff leaving.

Gearing Ratios: What Is a Good Ratio, and How to Calculate It – Investopedia

Gearing Ratios: What Is a Good Ratio, and How to Calculate It.

Posted: Sat, 25 Mar 2017 20:54:23 GMT [source]

Regulation of investment vehicles, such as hedge funds and of many of the investments an investment manager is permitted to make on behalf of a hedge fund, is still evolving and therefore subject to change. In addition, many governmental agencies, self-regulatory organisations and exchanges are authorised to take extraordinary actions in the event of market emergencies. The effect of any future legal or regulatory change on a hedge fund is impossible to predict, but could be substantial and adverse. In addition, if an investment manager engages in such over-the-counter transactions, the relevant hedge fund will be exposed to the risk that the counterparty (usually the relevant prime broker) will fail to perform its obligations under the transaction.

Meaning and Definition of Capital Structure

Prices for commodities are at a low level, traffic is small and bank earnings are much reduced in value. Quiet industries become active again, and there is a ready output of capital for development purposes. Failures are less frequent and business, although not large, is promising and from a state of depression comes back to a more normal condition.

- The debt-to-equity ratio and capital gearing ratio are widely used for the same purpose.

- Capital gearing is a British term that refers to the amount of debt a company has relative to its equity.

- The terms of debentures and long-term loans are less favourable to such enterprises.

- A gearing ratio is a useful measure for the financial institutions that issue loans, because it can be used as a guideline for risk.

Such hedging transactions may also limit the opportunity for gain if the value of the portfolio position should increase. Moreover, it may not always be possible for the investment manager to execute hedging transactions, or to do so at prices, rates or levels advantageous to the hedge fund. The success of any hedging transactions will be subject to the movements in the direction of securities prices and currency and interest rates, and stability or predictability of pricing relationships.

Asia‐Pacific Journal of Financial Studies

Eventually, because of the difficult business environment, LTDR has a negative relation with ROA and its probability value was also insignificant at 5% and 1% levels. Therefore, if this is not true then my results might be wrong in a way such that LTDR estimates might be too low or standard errors might be too high etc. Thus, this finding is however consistent with the trade-off theory which presumes that more profitable firms will borrow more, as they will have a higher motivation to shield their income from taxation. On the other hand, it is contradicting to the pecking order theory and its prediction that companies prefer to retain their earnings, to avoid the necessity to raise debt or external funding. The purpose of this study is to examine the impact

of capital structure on a firm’s performance in Hong Kong, which has been an

unsolved problem in the field of financial management. Eventually, for both

capital structure and performance, a panel data model has been adopted and the

empirical model used Return on Assets (ROA) as a proxy for performance, while

total debt (TDR) was proxied for capital structure.

Also, a company that suddenly becomes leveraged should be investigated to see if it’s a sign of distress or was there a recent capital investment that required the company to use leverage. These are ongoing fixed costs that the company must be able to pay to be able to continue doing business. A leveraged company is not necessarily bad but suggests that the company has a higher than average level of debt. Too much leverage can expose the company to financial distress and insolvency risk. The information in this site does not contain (and should not be construed as containing) investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

What is a gearing ratio?

Thus, the company must consider two off-setting effects—rise in cost of debt (Ki) and rise in cost of equity (Ke) as well as the decrease or increase in overall cost of capital (Ko) and total value of the company. Similarly, traditional approach shares with the view of NOI approach that beyond a certain point of change in proportion of debt the overall cost of capital increases leading to decrease in total value of the company. But it differs from the NOI approach in that it does not argue that the weighted average cost of capital is constant for all degrees of debt-equity mix. Thus, the cost of capital curve may be V-shaped which shows that application of additional debt in capital structure beyond a point will result in an increase in total cost of capital and drop in market value of the firm. This is an optimal level of debt and equity mix which every firm must endeavour to attain. Fixed investment requires equity financing but medium term capital needs can be fulfilled by debentures and preference shares.

- In particular, the closing-out of an over-the-counter derivative transaction may usually only be effected with the consent of the counterparty to the transaction.

- In Figure-6, X-axis shows the percentage of debt in financing mix, while Y-axis shows the cost of capital.

- There is no clear consideration of management incentives, as in Ross’s (1977) signaling equilibrium, in which the nature and conditions of the manager’s compensation package guide the decision between debt and equity.

- Gearing shows the extent to which a firm’s operations are funded by lenders versus shareholders—in other words, it measures a company’s financial leverage.

- The market is top heavy owing to persons having bought on rising prices, actuated by the hope of big profits on the bill market.

The net gearing ratio is the most commonly used gearing ratio in financial markets. The D/E ratio measures how much a company is funded by debt versus how much is financed by equity. Put simply, it compares a company’s total debt obligations to its shareholder equity. high geared company exposes to When sourcing for new capital to support the company’s operations, a business enjoys the option of choosing between debt and equity capital. Most owners prefer debt capital over equity, since issuing more stocks will dilute their ownership stake in the company.

Capital structure and firm value in China: A panel threshold regression analysis

Companies such as Coach and Vale and several other companies have been secondarily listed utilizing guide and introduction without necessarily raising new cash. Hong Kong’s equity market in past years has raised its first-hand funds from initial public offerings (IPOs), in some of those years growing more than London and New York combined. The price of certain Financial Instruments may be influenced by measures taken to stabilise the price of such Financial Instruments. Stabilisation enables the market price of a security to be maintained artificially during the period when a new issue of securities is sold to the public.

The applicable cash amount could decrease or increase from what it would have been but for such delay. Such deemed delay may in the case of cash settled Financial Instruments increase or decrease the cash amount payable at settlement from what it would otherwise have been but for such deemed delay. The value of Financial Instruments where a Third Party is the issuer or the counterparty is expected to be affected, in part, by investors’ general appraisal of the Third Party’s creditworthiness.

However, it cannot be assured that Deutsche Bank’s hedging and risk management activities will not affect such value. A short sale involves the sale of a Financial Instrument that an investor does not own in the hope of purchasing the same Financial Instrument (or a Financial Instrument exchangeable therefor) at a later date at a lower price. To make delivery to the buyer, the investor must borrow the Financial Instrument and is obligated to return the Financial Instrument to the lender, which is accomplished by a later purchase of the security. There exists potential settlement risk in respect of these over-the-counter transactions. Settlement risk is the risk that a counterparty does not deliver the Financial Instrument in accordance with the agreed terms after the other counterparty has already fulfilled its part of the agreement.